Rags to Riches to Rags: The Lehman Story

How a bank founded by the son of a cattle merchant became the 4th largest investment bank, before going bust

Make sure to subscribe to receive more long form content like this! Also, be sure to check me out on Twitter and my podcast!

September 15, 2008 is one of the best remembered dates in financial history. That day, America’s 4th largest investment bank filed for bankruptcy. How did it all happen?

The Founding and Early Days

The bank was founded by Henry Lehman, Emanuel Lehman and Mayer Lehman in 1850, who was a Jewish immigrant to the US from Bavaria. They had all settled in Montgomery, Alabama.

They were focused initially on the cotton market. Remember, this was 1850 - 15 years before Abraham Lincoln had signed the Emancipation Proclamation and freed the slaves after the US Civil War. And in Alabama, almost half the population was made up of slaves. The market value for cotton was high, while raw cotton from slave plantations was cheap, and thus the Lehmans shifted their focus to trading in cotton.

Eventually, commodity trading, after the Civil War moved to NYC, and in 1870 the New York Commodity Exchange was founded - with help from Lehman Brothers.

The firm also dealt in coffee (and was a member of the New York Coffee Exchange), and joined the New York Stock Exchange in 1887. And in 1899, the handled their first IPO - the International Steam Pump Company, which went into receivership in 1914 and reorganized in 1915.

The company survived the Great Depression by focusing on Venture Capitalism, as opposed to equities - as there was no demand for equities for a while. It also moved to the prestigious 1 William St. location, until 1980:

Lehman Brothers was well known for financing fast growing industries (which in a way was responsible for it’s own demise). Lehman underwrote DuMont (first ever TV manufacturer) IPO, and financed the Radio Corp of America - these were two rapidly growing businesses in the early-mid 20th century. Similarly, it famously underwrote the IPO of Digital, and the acquisition of Digital by Compaq. Again, both of these companies were in a way high fliers at the time.

The Middle Years

The major well recognized event was the acquisition of Lehman by Shearson/American Express for $360m, forming Shearson Lehman Hutton. This was the beginning of the famous ordeal over RJR Nabisco.

Shears Lehman Hutton had initially entered the leveraged finance business as fierce competition to Drexel Burnham Lambert (remember Michael Milken’s insider trading scandal?)

RJR Nabisco and Shearson Lehman had announced that RJR’s management was going to take Nabisco private at $75/sh, and the negotiations that followed involved the big Wall Street firms. You had the Morgan Stanleys, Salomons and Goldmans among other huge names.

KKR, a well known alternative-investment company, bid $90/sh for RJR, but RJR’s management bid at $112/sh, a whole 50% above the initial $75/sh bid! KKR then bid $109/sh, but the board of directors of RJR went with the $109/sh bid as they were “guaranteed” it, while the management team’s bid might not actually be $112/sh.

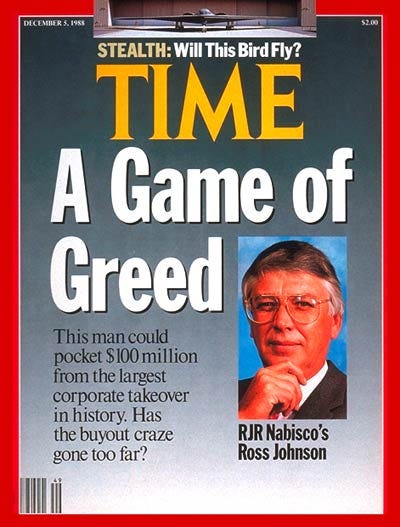

This was one of the best known events in Wall Street history, and here was Time Magazine’s cover page:

(Source: Time)

The other major event that happened was the 1997 blowup of Long Term Capital Management, where Lehman was involved. Richard Fuld, the CEO of Lehman had some “personal matters” that happened during the LTCM blowup that came into play when Lehman themselves blew up in 2008.

You see, when LTCM was being saved, every bank pitched in some money… except Lehman. One of the people who DID pitch in money was Hank Paulson, then the CEO of Goldman Sachs… and later the Treasury secretary who dominated the bailout decisions. Here is Bryan Marsal, one of the founders of Alvarez & Marsal, describing what happened.

The Treasury secretary, Mr. Marsal thought, “should have taken a back seat and let the pros from the Federal Reserve drive the bus.” Plus, as a former Goldman Sachs CEO, “Paulson simply didn’t like Dick Fuld, and he had run out of patience.” It didn’t help that in 1998, when Long-Term Capital Management needed bailing out, Wall Street got together and everyone kicked in, except Mr. Fuld’s Lehman.

-From WSJ

The Beginning (and the end) of the End

If I was asked to pick THE date when the Great Financial Crisis started, I’d go with 9th August 2007, when LIBOR rates decoupled from the Fed Funds rate. However, the climax of the subprime crisis was when Lehman collapsed and filed for bankruptcy.

Lehman got into the mortgage origination business in the late 1990s. In 2003, they made $18.2B in mortgage loans. One year later, it was $40B. As Mark Williams in "Uncontrolled Risk” described it, Lehman was basically a real estate hedge fund at this point. 4 years later, they hade $680B in loans… with just $22B in capital.

They were levered 30 to 1, and these were massive numbers. It’s very different to have a $30m position with $1m in equity capital. Sure, it could wipe out a budding hedge fund startup, but there is no systemic risk to financial markets with just $30m.

However, once those numbers are pumped up all the way to $680B like Lehman was, the risk goes up exponentially. If the loans went down 3.2% in value, their capital was wiped out. Any more, and they’d be taking big losses. See, the reason Lehman was so levered is they are an investment bank, and not a depositary institution.

In Q2 2008, Lehman lost $2.8B and Lehman stock was down over 70% in the first 6 months of 2008:

Initial reports said that Lehman might be bought out by Korea Development Bank but on Sep 9, those talks fell apart, and that day their stock fell 45%.

On Sept 10, Lehman lost $4B and two days later, the Fed was discussing how the bank should be saved (or whether it should be saved at all). Lehman was looking to be sold to Bank of America or Barclay’s, but the news came on Sept 14 that the talks had broken apart.

On Sept 15, Lehman filed for bankruptcy. This remains the largest bankruptcy filing to date. Remember Hank Paulson from the last section in the post? Some of the non - bailing out of Lehman was personal to Paulson, and was simply revenge for Fuld not helping bail out LTCM.

I hope you enjoyed reading this piece! If you’d like to learn more, you can find me here.

Great read Sri.