Before we start, I’d like to apologize for my 2 week hiatus without an article. I promise to be more consistent going forward.

I’d request you share/subscribe! Would mean the world to me

The reason for this article are some interesting comments made by Secretary Janet Yellen yesterday.

The Importance of US Treasuries in Repo

The US government treasury market is simply put, the single most important financial market in the world. US Treasuries are the most pristine form of collateral.

The interbank lending markets can be broadly “divided” into 3:

Repo markets

Eurodollar markets

Fed Funds markets

Ignoring the last two for now, repo markets are one of the most crucial markets, and a failure of the repo system could actually lead to a banking (and possibly financial) crisis.

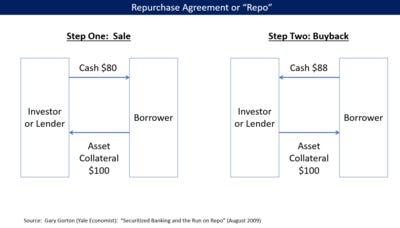

Repo stands for repurchase agreement. They are simply overnight loans to investors and tend to happen regularly.

(Source: Wikipedia)

In fact, one cause of the failure of Lehman Brothers in 2008 was the repo market, particularly what is known as ‘rehypothecation’.

Rehypothecation of repo collateral simply means you re-pledge collateral. So the same asset serves as collateral for multiple loans. What’s more, the US does not have a cap on the number of times an asset can be rehypothecated, and this leads to problems if these repos start to ‘fail’ (the overnight loan isn’t paid back). This led to a problem in March 2020, when we saw repo rates start to go through the roof.

The typical collateral for these repo loans is US Treasuries, and “on the run” Treasuries are the most pristine form of collateral, and thus Treasuries are crucial to the underpinning of the repo market.

The Federal Reserve estimates the size of this market at $4.6T, though some estimates are even higher. What’s clear is this market is crucial to the workings of a lot of funds, and financial markets.

There are other important uses of Treasuries - including serving as the ‘risk free’ rate in a lot of financial models, as well as being a place to ‘store’ cash and a safe haven.

Has the US ever defaulted?

The US, since Alexander Hamilton has only seen a ‘technical’ default in 1979, when a computer malfunction and Congressional hearings on the debt ceiling caused it to default on $122m in Treasuries (WSJ). These were then paid back later with full interest, and an additional payment for the delay (if memory serves me well).

The US otherwise however has never defaulted. It is worth visiting the events of 2011, when the US came close to a default.

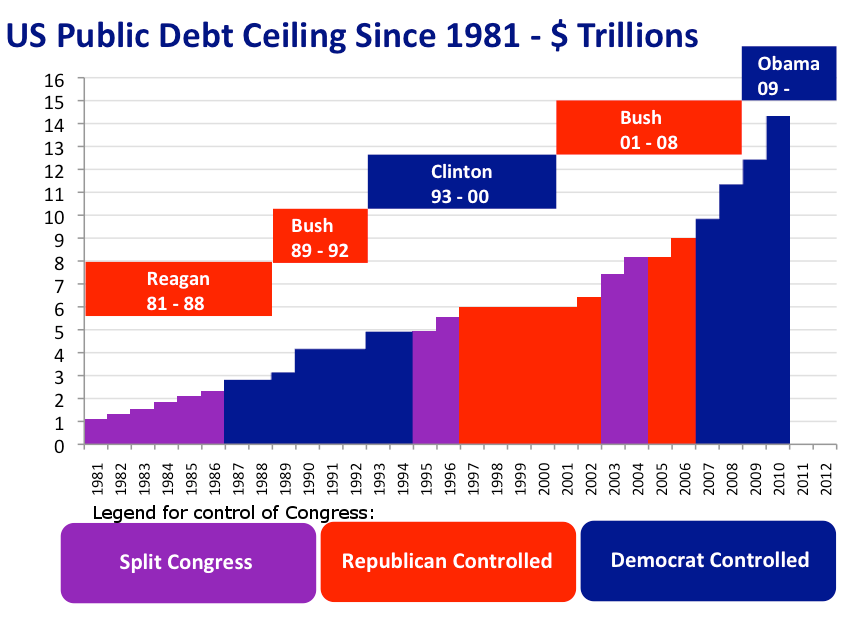

In 2010, the Republicans had taken the House of Representatives and were trying to get a quid pro quo - giving the Democrats an increase in the debt ceiling in return for smaller budget deficits.

(Source: Wikipedia)

Historically, there has never been a debate about the debt ceiling. It has always been a bipartisan act to increase it as time went by. If the US Treasury went above its debt ceiling, that would require either "extraordinary measures” or just default, plain and simple (or stop paying what it owes to lots of companies and individuals).

The consequences of US default are too great to be played around with. If either above of the above outcomes had arisen, we would’ve seen a repeat of the Great Financial Crisis, but far far worse.

If anything, think of it this way. The US Dollar is the world’s reserve currency, typically “stored” through the ownership of Treasuries by global central banks, mainly China (second largest economy in the world). A default in US Treasuries would be the death of the dollar, and the end of US financial hegemony, because US assets aren’t as safe as previously considered. The issue with this is there are no worthy alternatives to the US Dollar as a currency.

The West won’t trust China, and the Euro is structurally flawed (as detailed in my last post (which you can find here). This means the US simply cannot default.

What are the chances of a US default?

The inspiration for this article came from comments made by Sec Janet Yellen on the debt ceiling on the 23rd of July:

"If Congress has not acted to suspend or increase the debt limit by Monday, August 2, 2021, Treasury will need to start taking certain additional extraordinary measures in order to prevent the United States from defaulting on its obligations," Yellen added.

(Source: Reuters)

These comments are interesting to say the least. I personally think the chances of US default are <1%, and even under Obama they raised the debt ceiling thrice.

The 2011 debt ceiling issue was resolved two days before a possible default, and this sort of political brinksmanship poses a major risk to financial markets. If policymakers remain sensible, they would (and in my view are likely) to raise the debt ceiling before the 2nd of August. The risk here is it is 9 days away from the August 2nd deadline.

Is it possible the US defaults in the future? Maybe, but the two questions of:

What will the reserve currency be?

What will the ‘pristine asset’ be?

Need to be resolved.

The last point I’d like to put forth is the reminder that the US Dollar is (thankfully!) no longer backed by gold, and is a fiat system. This means the US has the ability to simply increase the quantity of money in order to pay off debtors. When you are in control of your currency, there is no need to default.

Warren Mosler, well known proponent of MMT, economist and author recalls a situation in the early 1990s. Mosler was then a hedge fund manager, running a macro portfolio. At that point in time, Italian government securities were trading at a higher yield than Italian corporate bonds. Keep in mind this was in the time of the Italian Lira (a sovereign currency) and not the Euro.

Investors were betting that the probability of an Italian sovereign default was higher than that of a corporate default. Mosler smelled a rat (and a profit!)

He realized that Italy could simply increase the money supply in order to avoid default. He flew to Italy to speak with the officials there and told them that printing money could avoid default, and so they did. When a government is in control of its currency, it has no reason to default.

An Italian crisis was thwarted, and Mosler made a nice profit.

This however turns into a problem when governments choose to default to avoid inflation, and that was what the Russian debt crisis in the late 1990s was based upon. The Russians didn’t have to default, they simply chose to, which shocked quite a few members of the finance committee.

The Conclusion

Going back to the US default, will they? I don’t think so. Why? To sum up:

There has historically not been much of an issue raising the debt ceiling

US policymakers are relatively smart, and understand the consequences

The USD is a fiat currency and thus can be indefinitely ‘printed’ to avoid collapse

Once again thank you so much for reading! It would mean a lot to me if you liked/commented/shared/subscribed! Once again, thank you!

I came here to see if anyone had a yield level that spikes default probability. I feel like there's a reason the Fed is raising rates slowly... I liked your comments on repo i'd love to learn more, I am very concerned about repo and default probability spikes.

Being a bit pedantic: The chance would need to be much, much, much less than 1%. Tail risk = the chance of something happening x the consequences of something happening. Doesn’t change any of your arguments, though.